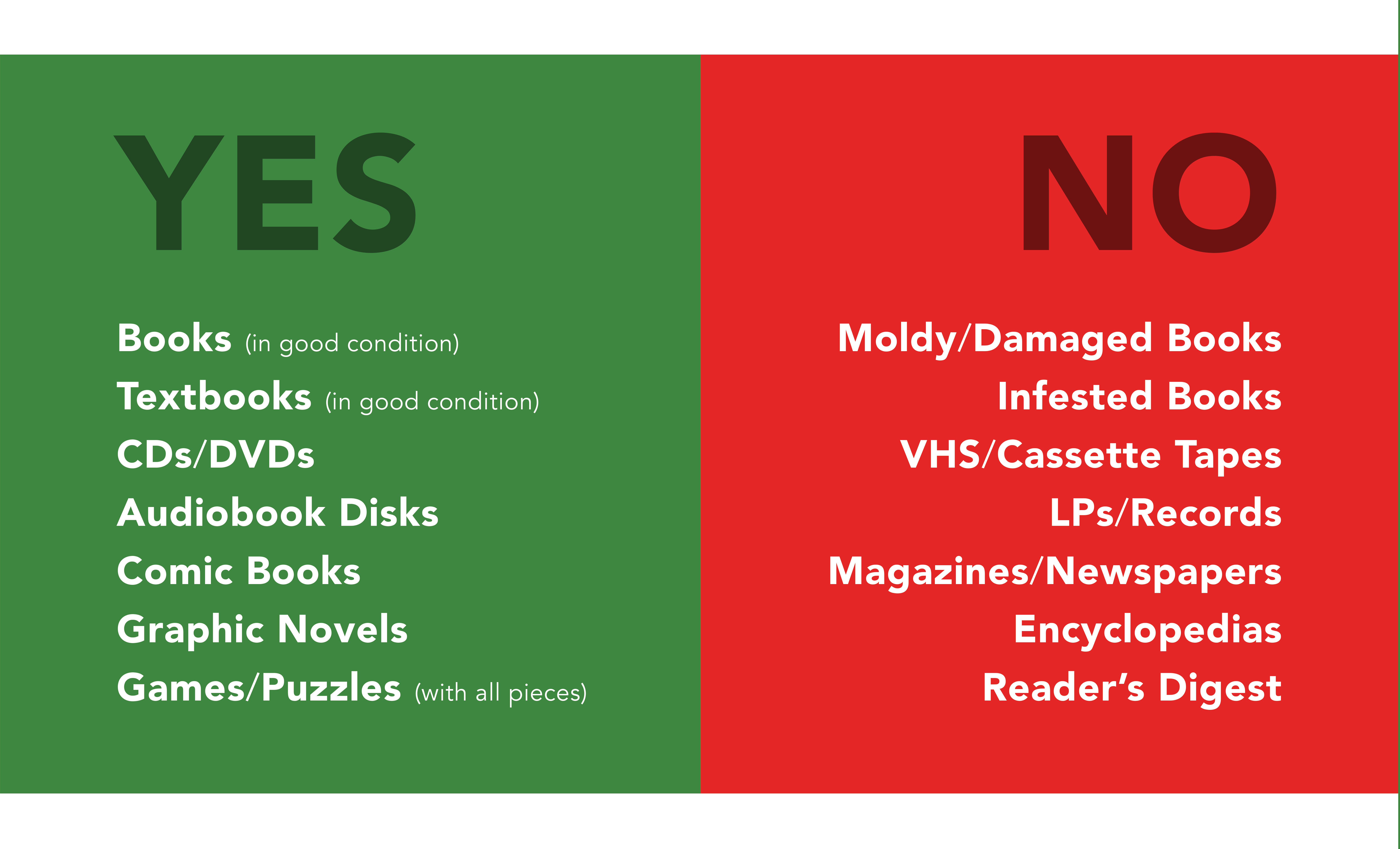

Donate Your Gently Used Books

When to donate:

DONATIONS CLOSED

July 3 through July 21

DONATIONS ACCEPTED*

MON | 9 AM–12 PM

TUE | 9 AM–12 PM

WED | 9 AM–12 PM

THU | 9 AM–12 PM

FRI | 9 AM–12 PM

SUN (last of each month) | 1–3 PM

July 27, Aug 24, Sept 28, Oct 26, Nov 30, Dec 28

*Check LPLKS.org for holiday and inclement weather closures

DONATION APPOINTMENTS

Appointments are needed for:

- Large donations (six boxes or more)

- Weekday afternoons

- Weekend appointments

Contact:

Angela Hyde, Program Coordinator

ahyde@lplks.org

785-843-3833 x149

Now that you have all that space, get fresh reads at our next sale, here..

Where to donate:

Our donation area is located on the Kentucky Street side of LPL, west of the library's main entrance. From Kentucky street, turn right into the book return drive. Go past the book return slots to the garage door. When we are accepting donations there will be a blue box outside of the garage door.

Donation Volunteers Needed

Can you devote a few days a month to help us bring in new donations? We really need the help!

FAQs: