This photo is a picture of my future self taken from my vision board.

Man, was I excited at mid Spring when I had in my sight the payoff date of my 20 year old student loan. For a couple years prior, I had been putting every extra cent I made working full time and also my profits from my side business towards the monthly payments. I was preparing the mother of all vacations, to go far away, eat at fine restaurants, and stay at the coolest Airbnb's.

Well, you know what happened.

Life was suddenly uncertain, the stock market was tanking on our retirement funds, we felt job uncertainty, and I had (have) no idea when normalcy will return.

After a couple weeks on the couch, and many, many hours of true crime podcasts later, I dealt with my incertitude by deep diving into the world of finance. With a firm understanding of finance guru Dave Ramsey's basic teachings, I started binging on financial independence blogs, podcasts, and books. I turned into a finance amateur. Do you understand the power of compound interest, ETFs, IRAs, index funds and inflation? I do, and I now think it's exciting!

I have chosen to highlight these books for you because they helped me as a beginner to understand the power of compound interest, the difference in retirement accounts, and also a safe way to dip your toe in the stock market. Using the teachings contained in these handbooks I hope to be able to have enough of a money cushion to weather the next who-knows-what.

I liked listening to this book because it interspersed the teachings of paying off debt, saving more money, and simple investing tips with real stories from other bloggers in the FI community. Conversations such as saving money using credit card points for vacation savings, pros and cons of going to college, and the basics of getting into real estate investing.

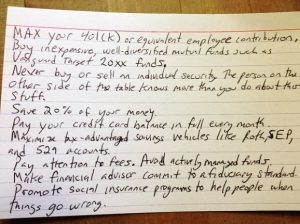

10 simple rules written on a, you guessed it, index card inspired the writing of this book. Your finances are not complicated, and you most often don't need a financial advisor to build a strategy for wealth. Cleverly, the size of this book is close to the size of an index card also.

This is the first book I have found that clearly helps you move from step A to B in monetary value examples that were close to mine. Also it assuredly discussed his preference for passive investing and why he suggests it in a way that made sense.

This is a lighthearted book that reads like fiction in that it has characters and stories that teach you how to manage your money in a clever way.

A failure to recognize financial literacy as one of the core skills needed to succeed in the 21st century is a sad reality. So go now-read, get started and also teach your children. There is a lot of compound interest to be made and inflation to keep up with.

-Angela Longhurst is an Accounts Services Assistant at Lawrence Public Library.

Add a comment to: Books I Think Are Better Than Dave Ramsey’s